Growing a tax practice isn’t as simple as hanging an ‘Open for Business’ sign and waiting for clients to pour in. The most powerful growth strategy isn’t fancy advertising or social media trends: it’s the time-tested power of referrals. When satisfied clients become your advocates, they bring something no marketing budget can buy: trust.

Think about it. Every successful tax practice has that magical moment when referrals start flowing in naturally, creating a snowball effect of growth.

Whether you’re a seasoned tax professional or just starting your practice, a well-structured referral program can transform occasional recommendations into a consistent stream of pre-qualified clients.

In this guide, we’ll unlock the secrets to building a referral program that works year-round, not just during tax season. You’ll discover proven strategies, practical tools, and real-world examples that will help you turn your satisfied clients into your most effective marketing force.

The Magic of Tax Service Referrals

Being a tax preparer means understanding one vital truth: trust is your most valuable currency. Clients who believe in your tax preparation services become your most powerful marketing force.

Let’s explore why referrals can transform your practice.

Why Referrals Are Your Best Friend

The trust factor in this industry is unmatched. When a referred client walks through your door, they’re already confident in your abilities because someone they trust vouched for your tax preparation services. Small-time business owners especially value these recommendations—they’re not just looking for someone to file a tax return, they want a trusted advisor.

When it comes to effectiveness, the numbers speak for themselves. According to research by Deloitte, referred customers have a 59% higher lifetime value and a 37% higher probability of making another purchase. Plus, the Wharton School of Business found that the churn rate of referred customers is 18% lower than that of other marketing channels, making them significantly more valuable to your practice over time.

If you like numbers (as any tax planner or accountant would), you can read more stats from our post on Referral Marketing Statistics.

Client retention rates soar with referrals. When your current clients start referring friends, these new clients stick around three times longer than those who find you through other means. They’re already sold on your advisory services before they even meet you.

The growth potential is exponential. One satisfied client referring friends can bring five new customers, bringing more referrals. Without an expiration date on your program, this cycle keeps growing your practice organically.

The Psychology Behind Tax Service Referrals

People trust their peers’ financial recommendations more than any advertisement. When someone needs to save money on taxes, they turn to friends who’ve had positive experiences with tax preparers.

The ripple effect is powerful in financial services. Your clients don’t just refer you because of the referral reward. They do it because they genuinely want to help their network make smart financial decisions.

Social proof works wonders in professional services. Each successful referral strengthens your reputation. Business owners talk to other business owners, creating a network effect that naturally expands your client base. This natural expansion brings more referrals and new clients aligned with your service approach.

Building Your Referral Program Foundation

Ready to launch your tax services referral program? Hold your horses! Before jumping in, let’s ensure you’re set up for success. Think of it like preparing a perfect tax return—it’s all about having the correct elements in place.

Are You Ready for a Referral Program?

The foundation of a successful referral program starts with your current practice.

- Do you already have some clients?

You’ll need a solid base of satisfied clients—we’re talking about at least 50 regulars who return each tax season.

- Do you have the means to provide rewards?

Don’t forget about having the financial capacity to offer meaningful referral rewards that motivate referrals.

- Speaking of satisfaction, how happy are your current clients?

Your practice should already have consistently positive feedback on your tax preparation services, clear processes for managing client relationships, and staff trained in delivering exceptional service.

Before asking them to bring new customers through your door, ensure they’re genuinely thrilled with your advisory services. This means actively gathering feedback through satisfaction surveys, monitoring online reviews, and tracking repeat business rates.

If you interact with your clients online or through your website, you can ask them how likely they are to refer your business.

If clients aren’t coming back for more than just tax preparation, it’s crucial to understand why and address any issues before launching your program.

- Do you have the capacity?

Can your practice handle an influx of referred clients? Think about how many new clients each tax preparer can realistically manage, especially during tax season rushes.

Your scheduling system needs to be efficient, and your team must maintain service quality even with a 25% increase in clientele.

- Your digital infrastructure needs to be robust.

A successful referral program requires a solid client management system that tracks referrals, software to monitor referral rewards, online booking capabilities, secure document-sharing platforms, and automated email systems for follow-ups.

Creating Your Dream Client Profile

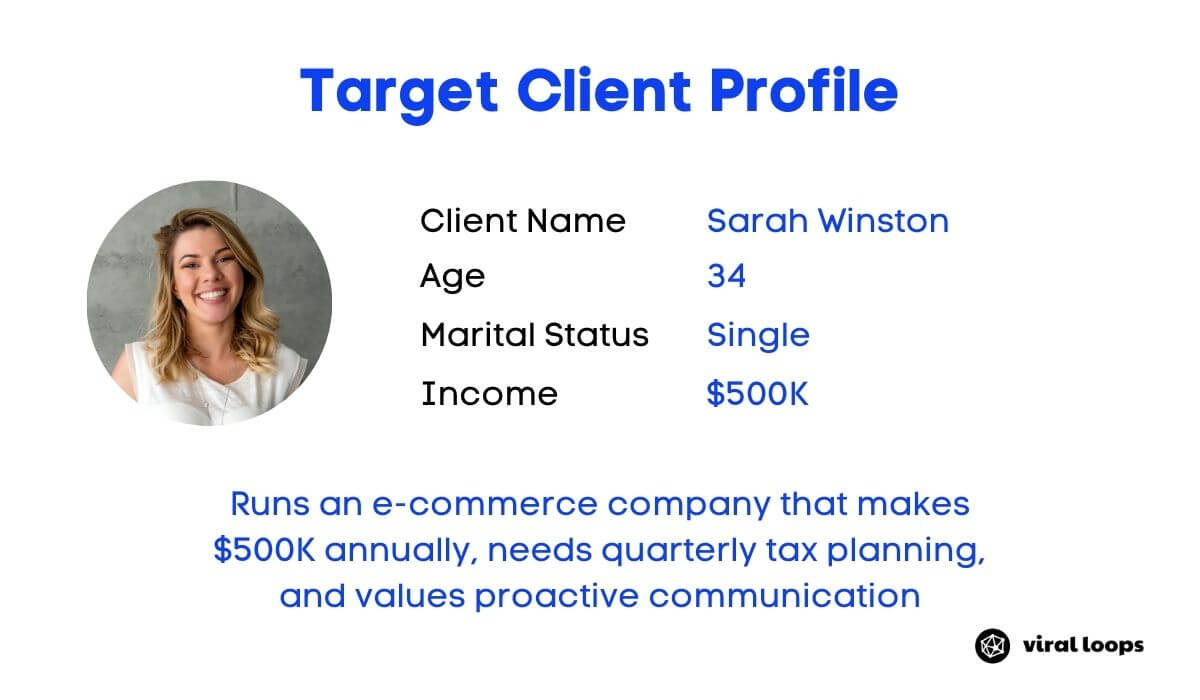

It’s time to get specific about who you want your clients to refer. You need to know them well by setting up a Target Client Profile. Let’s create an example.

Meet Sarah, your ideal referred client.

She runs an e-commerce company that makes $500K annually, needs quarterly tax planning, and values proactive communication. She has complex tax situations that require advisory services and is willing to save money by investing in professional guidance. Best of all, she actively networks with other small business owners.

You need to understand client pain points by now. Your ideal clients are likely struggling with tax compliance, worried about audit risks, and need help maximizing business deductions. They’re looking for year-round tax planning support and ways to reduce tax liability through strategic planning.

If this is your target client, then you should focus on tech-savvy entrepreneurs aged 35-50 who value professional expertise.

These clients are typically active on social media, network with other small businesses, and prioritize long-term financial planning. They understand the value of quality service and are willing to invest.

Remember, your referral program will attract clients similar to your current ones. That’s why defining your ideal client helps you structure rewards and messaging that resonate with both existing clients and the new customers they’ll bring in. Your tax preparation services will grow most effectively when you know who you want to serve.

Defining your ideal client helps you structure rewards and messaging that resonate with both existing clients and the new customers they'll bring in. Share on XThe Nuts and Bolts of Your Tax Referral Program

Now that you have the basics, you’re ready to turn your satisfied clients into enthusiastic advocates for your tax preparation business. Let’s discuss the details of building a referral plan that works.

As tax preparers, we know that the devil is in the details—just like with a complex tax return.

Here’s how to structure a program that brings results year after year:

Program Structure

1. Rewards System

The foundation of any successful referral program is a double-sided reward system that benefits both parties.

Think of it as a win-win deal: your current client gets rewarded for making the introduction, while their friend (your potential new client) receives a welcome discount on their first tax preparation service. This approach creates motivation on both sides of the referral equation.

Recommended Reading: How to choose referral rewards and referral incentives

2. Launch Schedule

Timing is everything in our industry. While most tax preparers focus their referral efforts during tax season, a year-round program can yield better results.

Why? Because tax planning needs don’t stop on April 15th. Small business owners and self-employed individuals need your services throughout the year, making every month an opportunity for more referrals.

3. Referral Monitoring

Manual spreadsheets are no longer sufficient for tracking referrals. Modern referral programs need robust tracking systems that automatically monitor referral sources, conversion rates, and reward distributions.

Consider investing in dedicated referral marketing software that integrates with your existing client management system. This technology tracks referrals, automates reward distribution, and provides valuable analytics about your program’s performance.

Reward Strategies That Actually Work

Let’s talk about what motivates people to refer. While cash rewards are popular, they’re not the only way to incentivize referrals. Consider offering a mix of monetary and non-monetary rewards.

For the referring client, this could mean a percentage off their next tax preparation service, a cash bonus, or even a donation to their favorite charity in their name. However, an attractive first-time service discount often works best.

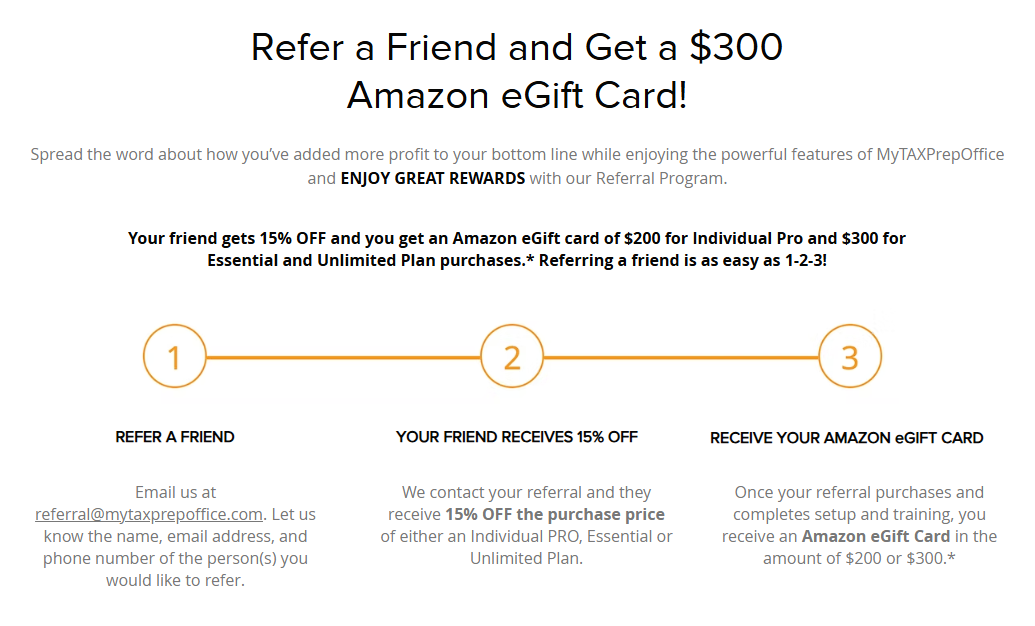

This example can catch anyone’s attention to become a part of your referral team:

A tiered reward structure can supercharge your referral strategy. Start with a basic reward for the first referral and increase the value for additional referrals within the same tax season.

For example, offer 20% off next year’s tax preparation for the first referral, 30% for the second, and maybe even a free return for three or more successful referrals. This approach encourages clients to think beyond just one referral.

Special promotions during tax season can boost your program when it matters most.

Consider launching a “Tax Season Referral Challenge” with premium rewards for top referrers. This could include exclusive perks like priority scheduling during peak season, complementary tax planning sessions, or even high-value gift cards to popular retailers.

Remember to time your promotional pushes strategically.

While your program runs year-round, amp up your referral messaging about six weeks before tax season begins. This gives clients time to spread the word before the rush hits.

Send reminder emails, create social media content, and make sure your staff actively mentions the program during client interactions.

Remember, successful referral programs aren’t shouldn’t be: they evolve based on client feedback and performance metrics.

Keep track of which rewards generate the most interest and adjust your offerings accordingly. A flexible, well-structured program will keep bringing in quality referrals long after tax season ends.

Implementation Playbook

Turning a customer referral from concept to reality requires careful planning and strategic execution. Here’s a comprehensive guide to launching and promoting a successful tax service referral strategy.

Launch Sequence

The ideal time to launch a referral plan is three months before tax season begins. This timing allows for proper setup and testing before the peak period.

The first step is establishing the technical infrastructure. This means implementing a reliable referral tracking system and setting up reward automation processes.

Staff training is crucial for program success. Comprehensive training sessions should be scheduled in the first week, covering program mechanics, reward structures, and common client questions.

Creating a reference guide with frequently asked questions helps ensure consistent communication across the team. The goal is for every team member to explain the program to clients confidently.

Promotion Tactics

A well-planned promotional strategy ensures maximum program visibility and participation. Instead of taking a scattered approach, tax firms should implement targeted promotional efforts across multiple channels.

Digital Channels

The website should feature the referral program prominently, with clear calls to action throughout the digital experience:

- A dedicated referral program button on the homepage

- Integration within the client portal dashboard

- Strategic placement of referral links in headers and footers

- Mobile-optimized referral pages for easy access

Email Campaign Strategy

Email communications should follow a segmented approach:

- Personalized launch announcements for high-value clients

- Mass program announcements for a general client base

Integration into regular client communications:

- Monthly newsletters

- Post-service surveys

- Tax preparation confirmations

- Seasonal tax updates

Social Media Strategy

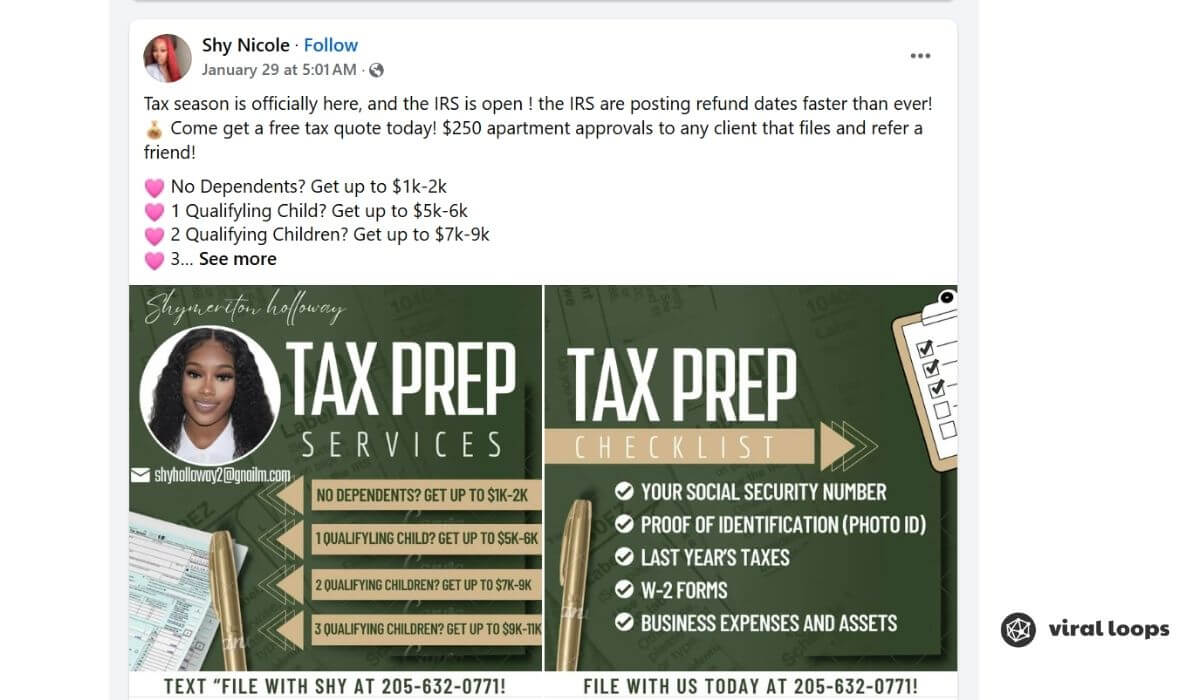

Social media promotion requires consistent, engaging content:

- Regular program highlights

- Success stories (with client permission)

- Reward announcements

- Shareable tax tips and advice

In-Office Promotion

Physical promotion remains effective for tax services. Key elements include:

- Counter displays with program information

- Brochures included in client materials

- Digital screens showcasing current rewards

- Branded thank-you cards with program details

Monitoring and optimization are essential components of the implementation process. Regularly reviewing program metrics helps identify areas for improvement and ensures the program evolves with client needs and business objectives.

This structured approach to implementation creates a sustainable referral system that generates consistent results throughout the year, not just during tax season. The key is maintaining momentum through regular promotion and engagement across all channels.

Making Your Tax Referral Program Work Like a Well-Oiled Machine

Successful referral programs rely on consistent tracking, efficient automation, and clear communication in the tax services industry. Regular monitoring ensures that all rewards are issued promptly, crucial for maintaining program momentum.

Tracking referral sources is essential to identify which channels deliver the best results. Some common pitfalls include failing to follow up with referrers, inconsistent reward distribution, and complex redemption processes.

Successful programs maintain a 24-hour response time to both referrers and referred clients, ensuring everyone stays engaged. Client communication should focus on clear program instructions, prompt updates on referral status, and timely reward notifications.

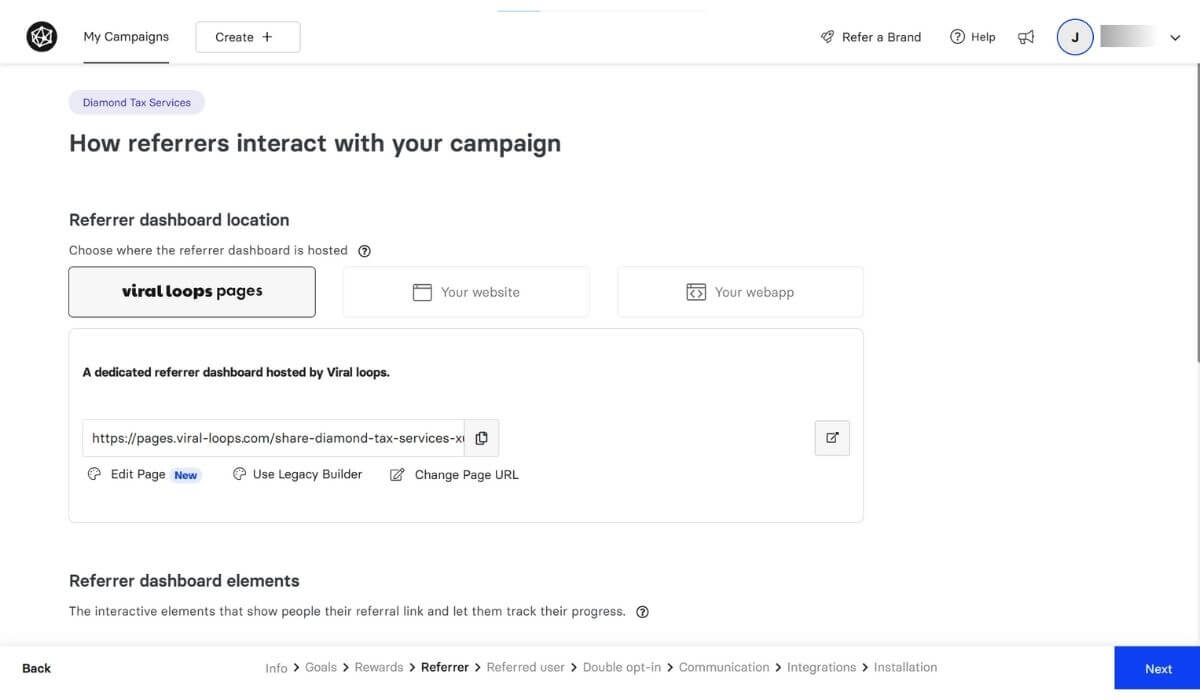

Using Automation Tools

Dedicated software solutions benefit modern tax service referral programs significantly. Viral Loops provides essential features, including:

- automated reward tracking

- customizable templates designed specifically for tax services

- comprehensive analytics dashboards

The platform’s Campaign Wizard simplifies program setup, while its real-time monitoring capabilities help track program success.

For optimal performance, integrate referral software with existing client management systems. Create standardized workflows for client communications, reward distribution, and referral tracking.

With the help of CRM integrations, you can set up automated email sequences for different stages of the referral process: initial invitations, reminder messages, successful referral notifications, and reward confirmations.

You can also track key performance indicators, including referral conversion rates, time from referral to completion, reward distribution speed, and overall program ROI.

Pay special attention to retention rates of referred clients, as they typically show higher loyalty than clients acquired through other channels. Monitor the average value of referred clients compared to standard acquisitions to demonstrate program effectiveness.

Success in referral marketing comes from consistent execution and regular optimization based on performance data. With proper automation and tracking systems in place, tax professionals can focus on serving clients while their referral strategy drives sustainable growth.

Supercharging Your Results

Advanced strategies can transform a basic referral program into a powerful growth engine for tax services. Here are some best practices we recommend:

1. Time Promotions Strategically

Strategic timing of promotions, especially during peak tax seasons, creates urgency and motivation for participation. For example, double rewards in January and February can drive early tax filing while maximizing referral participation.

2. Show Client Appreciation (More than Simple Rewards)

Client appreciation events serve multiple purposes in amplifying referral success. Hosting quarterly appreciation gatherings where successful referrers are publicly recognized creates a community atmosphere and motivates others to participate.

These events can be virtual or in-person, featuring special perks for top referrers such as priority scheduling for the next tax season or exclusive financial planning sessions.

3. Make Full Use of Social Media

Everybody’s on social media nowadays.

Social media amplification strategies should focus on sharing success stories and program benefits.

Tax professionals can leverage platforms like LinkedIn and Facebook (Meta) to showcase testimonials and highlight reward milestones. Creating shareable content about tax tips and deadlines naturally integrates with referral program promotion.

4. Expand Your Business Network

Strategic partnerships with complementary professionals multiply referral opportunities.

Establishing relationships with estate planners, insurance agents, and financial advisors creates a network where referrals flow in multiple directions. These partnerships often lead to joint client education events, expanding reach and credibility.

Wrapping Up

Remember that successful referral programs aren’t just about rewards—they’re about building trust and delivering exceptional service worth recommending.

Having a clear program structure, automated reward systems, and year-round engagement strategies can help drive the growth of your tax preparation business.

The success of a tax service referral program hinges on strategic planning, consistent execution, and the right tools. And what better tool to start with than Viral Loops? Start with a free trial today!