Customers are the bread and butter of any business – without them, you don’t have revenue!

As a marketer, it’s your job to find the people who can see the value in what you offer and bring them on board as a customer.

Scratching your head thinking how to do that?

You need our guide to customer acquisition, which is what we’ve put together for you right here.

We’ve got a complete rundown of everything you need to know about customer acquisition, including:

- A definition of customer acquisition

- The reason you need to focus on customer acquisition

- How customer acquisition and retention differ

- An example of a customer acquisition strategy

Before finishing up with a customer acquisition cost calculator that you can use for your own marketing efforts.

Ready to talk about customer acquisition? Let’s do this.

Table of Contents

What is the Purpose of Customer Acquisition?

What is the Difference Between Customer Acquisition and Customer Retention?

A Simple Customer Acquisition Strategy for Startups

How to Calculate Customer Acquisition Cost

Frequently Asked Questions (FAQs)

What is Customer Acquisition?

Customer acquisition is the process of finding new customers for your business, giving you new people to build relationships with and add value for.

In marketing, customer acquisition is when you specifically reach out to people who have found out about your company and work to help them make the decision to buy your product or service.

Acquiring customers is done in partnership between your marketing team and your customer services team, who need to help you talk to potential customers.

You’ve probably heard of the concept of a marketing funnel, where you lead people down the path of:

- Becoming aware of your brand

- Considering making a purchase

- Deciding to buy your product

This is the high-end overview of the steps of customer acquisition and once they’re your customer, it becomes a case of customer retention, which we’ll get into a little further down in this post.

Customer acquisition requires investment in marketing, sales, and any other activity that helps you to acquire new customers.

The success of this investment is measured by customer acquisition cost (CAC).

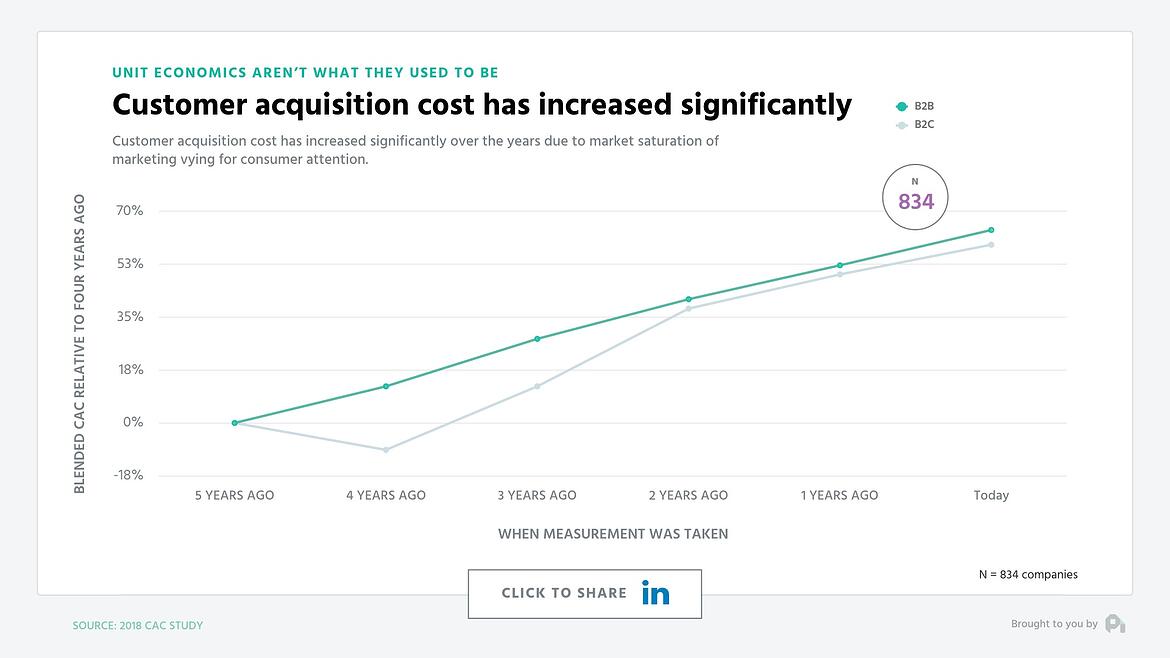

In the five years up to 2018, Profitwell measured an increase in customer acquisition costs of nearly 50% across 834 B2B and B2C companies.

Image Source: Profitwell

Image Source: Profitwell

Although the data was sourced a few years ago, it’s unlikely to have changed much over that period.

Now you know what customer acquisition is, let’s check out why you need it.

What is the Purpose of Customer Acquisition?

The purpose of customer acquisition is to find, engage with, and convert people into new users or paying customers – a business needs to generate revenue to be able to survive.

We already looked at a simple outline of a customer acquisition funnel – these efforts are there to guide people towards becoming a lead and making a purchase, meaning your business has the money to pay salaries and keep the lights on!

Even when your business has a loyal base of customers making repeat purchases, you still need to be working to find new customers.

New customers will mean losing existing ones won’t be as damaging to your bottom line, but most importantly, it means that your business will be able to grow and profits will be increased.

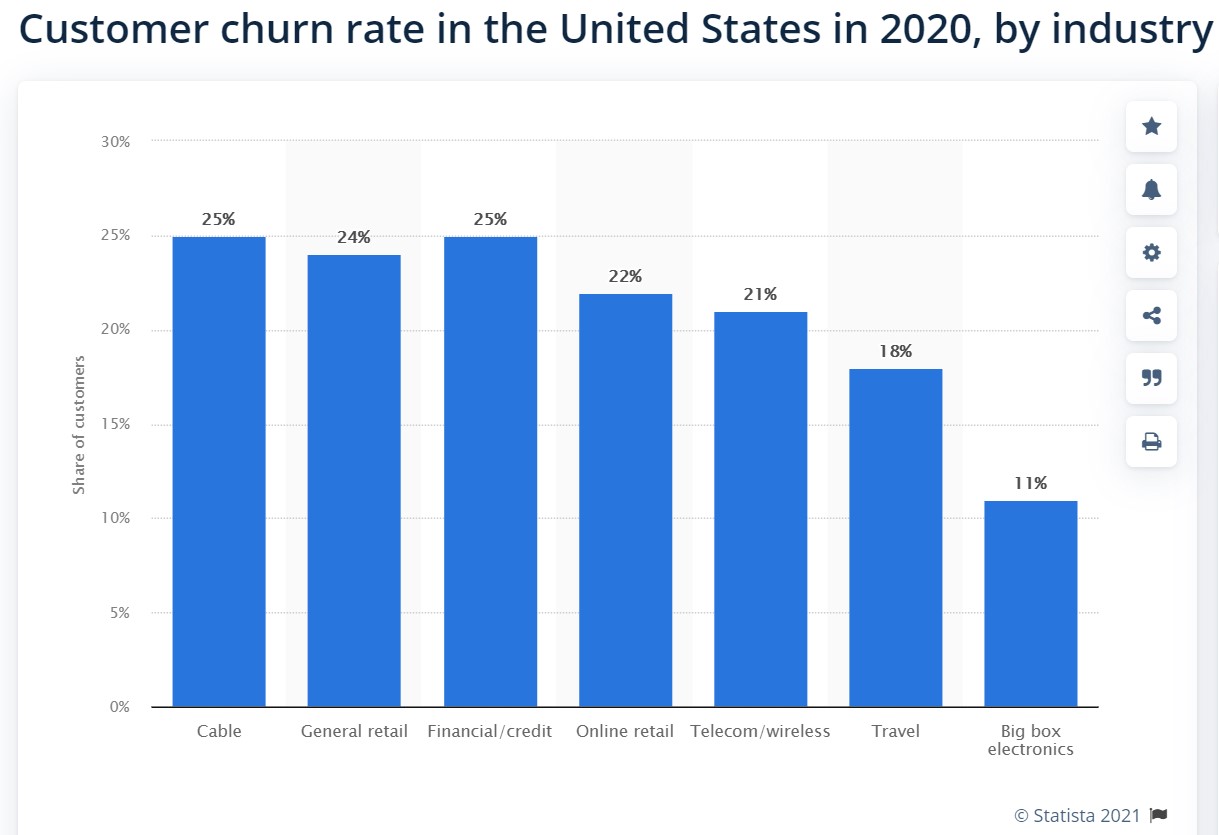

Image Source: Statista

Image Source: Statista

As you can see in the graph above, the number of customers who stop using a service – called the churn rate – can be up to 25% in some sectors, meaning you need to have channels ready to replace those who leave you.

Customer acquisition is clearly an important element in marketing strategy, too; 65% of marketers reported that they’d be focusing on customer acquisition in 2021.

You’ll often hear customer acquisition in the same conversation as customer retention, so let’s untangle the two for you.

What is the Difference Between Customer Acquisition and Customer Retention?

Customer acquisition is about finding new customers for your product or service while customer retention is keeping them on board once you’ve closed the first deal.

There’s a little more to it when it comes to how to run and measure acquisition and retention campaigns, so let’s look at the details.

Customer acquisition

The important elements of customer acquisition are:

- Customer acquisition is about running marketing campaigns to find new customers.

- The main metric used to measure acquisitions is the CAC.

- The awareness, consideration, and conversion stages of the sales funnel are influenced by customer acquisition.

- Common customer acquisition channels include content, SEO, pay-per-click (PPC) advertising, social media marketing, and influencer marketing.

- Results of a customer acquisition campaign can take a long time to show results.

How do these points look for customer retention?

Customer retention

When we’re talking about customer retention, here’s what you need to know:

- The point of customer retention is to keep your existing customers loyal and happy to keep purchasing from you.

- To measure customer retention, the metrics you can look at are customer lifetime value (LTV) or your customer churn rate (lost customers/total customers x 100).

- In the sales funnel, customer retention works on the loyalty and advocacy stages.

- The most common channels for customer retention marketing include using your email list, mobile messaging, and retargeting Facebook ads or Google ads, while product marketing is also a strand of customer retention.

- The results of customer retention activities can be cost-effective and are often seen quickly, depending on your product lifecycle and business model.

In fact, when a business increases its retention rate by 5%, it’ll likely see an increase in profits of up to 95%.

Both acquisition and retention are important to your business and marketing budgets and efforts should reflect this.

Once you’ve got the attention of your target audience and converted them to new customers, a great customer experience is going to keep them around and spreading the word about your business through word-of-mouth.

Getting to the point of retaining loyal customers requires a customer acquisition strategy, which is what we’re looking at next.

A Simple Customer Acquisition Strategy for Startups

Now you know how important customer and user acquisition is, you need to understand how to implement an effective customer acquisition strategy.

To let you understand what a valuable acquisition marketing campaign looks like, we’re going to go through a hypothetical example with you.

Here, let’s say we’re a fintech company readying to launch a second service after a first successful launch; we’ve got a healthy number of customers already on board for our first service.

We also have a customer contacts database, an email marketing tool, and an existing website.

Time to see how we’d go about our new customer acquisition campaign.

Step #1: Choose the acquisition channels you’ll use

The first step in creating your customer acquisition plan is to choose the channel or channels you’re going to use.

Which one you choose will usually be determined by your target audience, their demographic, and where you can reach them, plus what resources you have available.

Some of the most common acquisition tactics and strategies include:

- Referral marketing – this is when you ask your current customers or leads to refer their friends and family to your company, with a reward for them and sometimes for the person they refer as well.

- Social media – you’ll need to understand which platform your ideal customer uses; business professionals are more likely to use LinkedIn, younger people tend to use TikTok, and Millennials and Gen X can be found on Facebook, for example. You’ll need to decide whether you want to spend money on advertising or time on organic reach.

- Search engine optimization (SEO) – this is a good channel to use once your company has achieved product-market fit and is able to invest in long-term customer acquisition strategies. A strong SEO strategy will be built around good content marketing.

- Pay-per-click (PPC) or paid advertising – when you pay for your brand to appear on search engines like Google and are charged each time someone clicks through to your site; this type of campaign can bring fast results and easy-to-measure costs.

In our hypothetical example, we’re going to choose a referral program to acquire customers for our fintech company.

This is because we have a new product to launch and a foundation of customers who are already loyal to our brand.

We also know that fintech companies often use referral marketing to build anticipation and buzz about their new products so it’s been successful for others.

Now we need to know how we’re going to understand what successful acquisition efforts will look like.

Step #2: Define your goals and KPIs

For our referral marketing campaign to acquire new customers for our product launch, we need to understand what success looks like.

Having a clear set of goals for your customer acquisition effort will mean that you can test your efforts and either ramp them up or shift focus to a different strategy.

The main target of any customer acquisition campaign will invariably be the number of new customers you attract and how much that costs – the customer acquisition cost that we covered earlier.

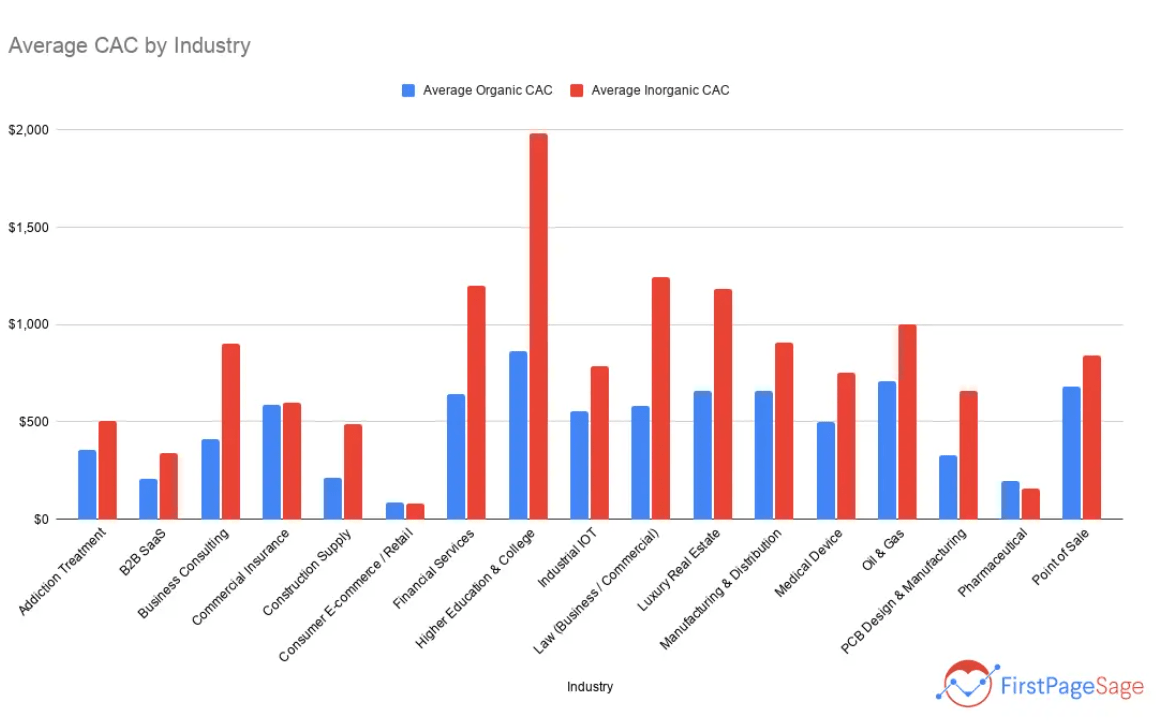

Each industry has a different standard for CAC, here’s a selection of some B2B averages to show you how varied this number can be:

Image Source: First Page Sage

Image Source: First Page Sage

We also need to define some metrics specific to our referral marketing campaign, such as:

- The viral coefficient: divide the number of registrations by the number of unique inviting customers to give you how many new customers each of your current customers bring.

- Participant conversion rate: divide how many people become a new customer by how many visited your campaign landing page to tell you how many people turned from leads to customers.

- Participant share rate: calculate the average number of unique shares each person on your campaign does; more shares should turn into more customers acquired.

- Invitation click-through rate (CTR): How many people clicked on an invitation link divided by how many invitations were sent, which can be boosted with personalized messages.

- Invitation conversion rate: Divide how many customers were acquired through an invitation link by how many people clicked on invitation links in the campaign to know if you need to work on landing page optimization, for example.

When you know what success looks like, you can be sure your efforts are effective and offer a good return on investment (ROI).

Step #3: Create your customer acquisition campaign

The next step in our customer acquisition process is to create our acquisition campaign.

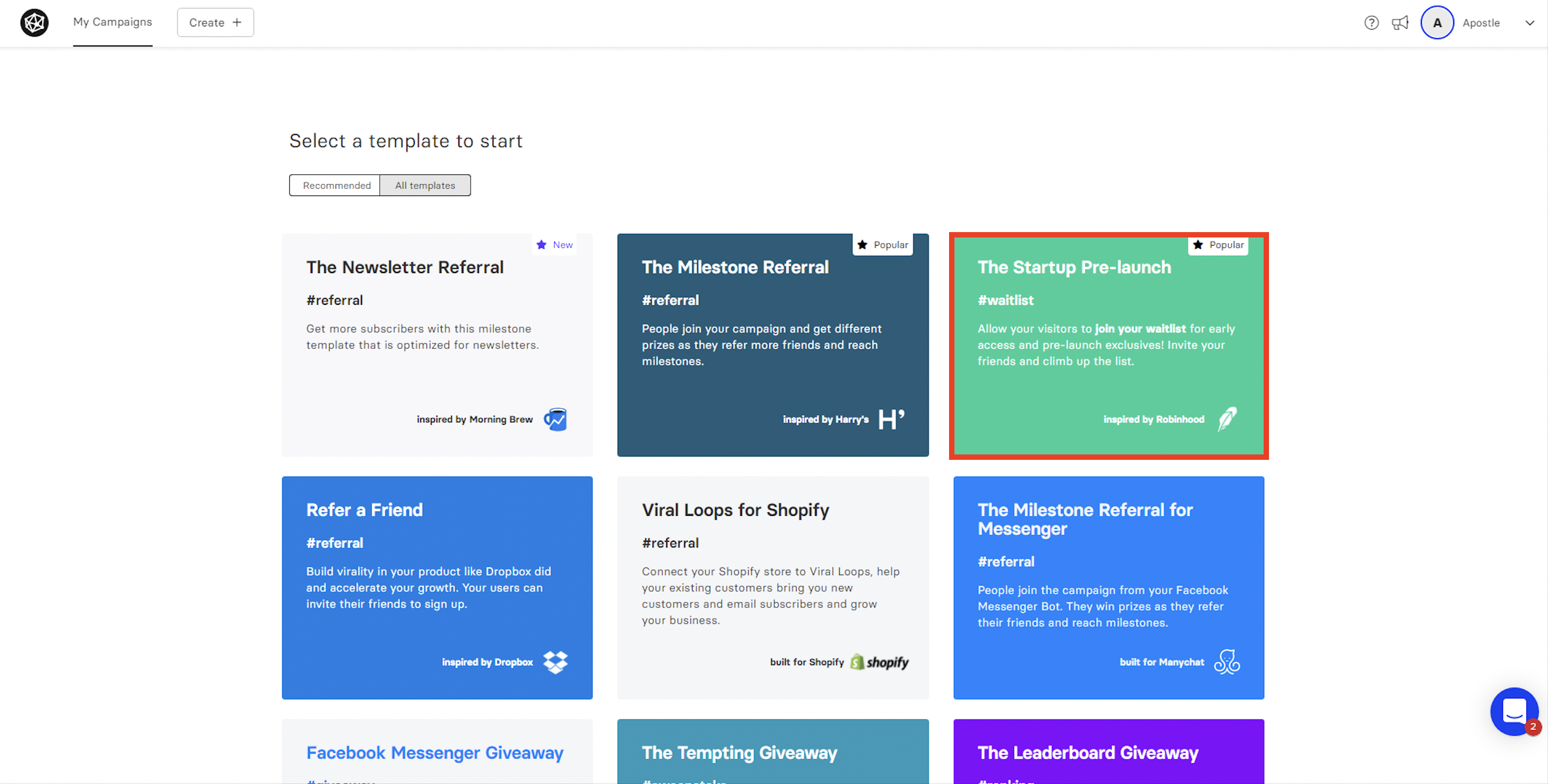

For this we’re going to use Viral Loops and work with the Startup Pre-launch referral campaign template; it’s popular with fintech companies and suits our needs since we want to ask our current customers and their friends and family to join a waiting list for our new product.

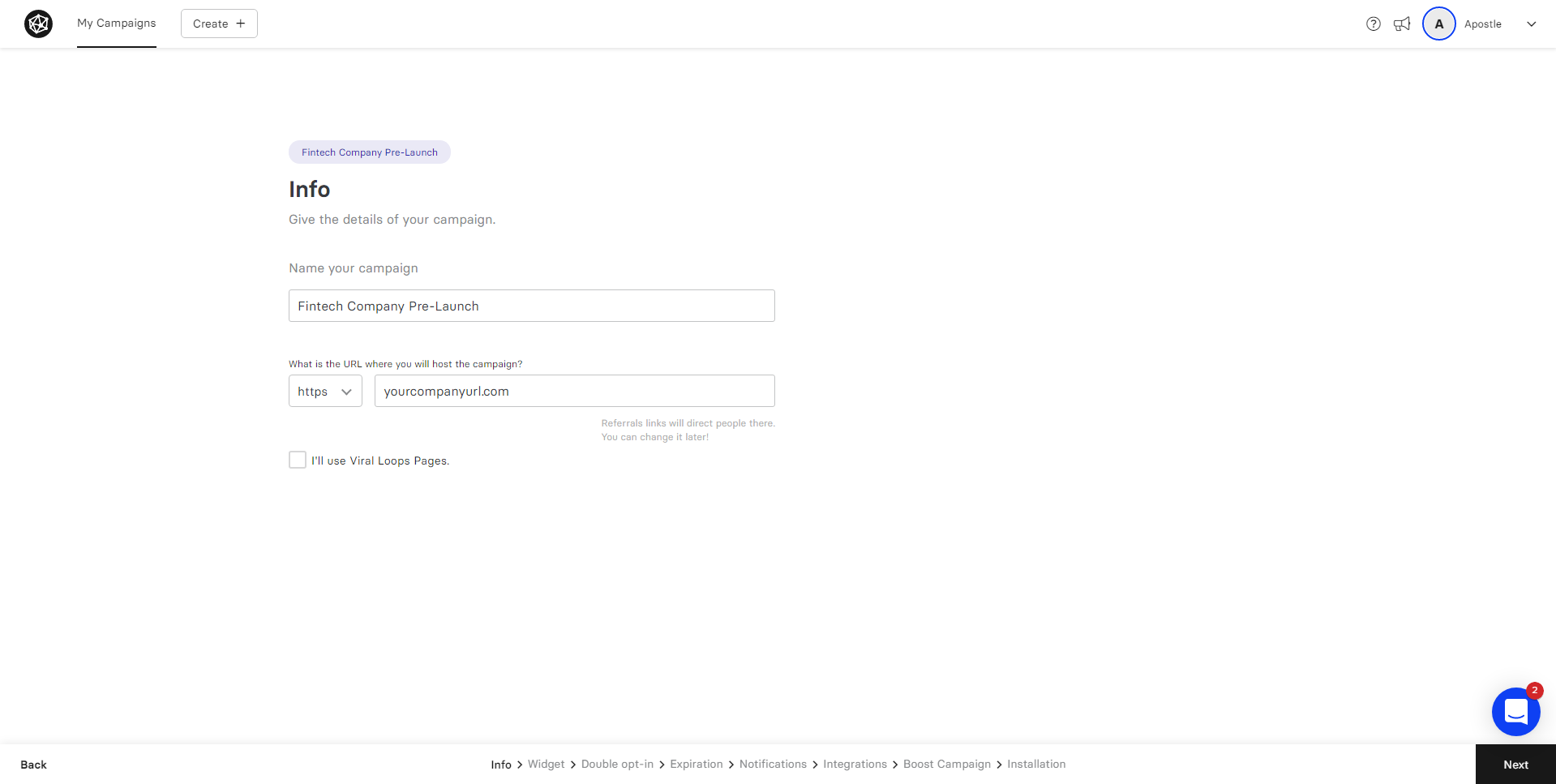

Next, we fill in our campaign information by giving it a name and adding our domain name:

Next, we fill in our campaign information by giving it a name and adding our domain name:

At this point, we could opt to use the landing page builder tool that Viral Loops offers, but since we have an established website we’ll use our own site and add the campaign there.

At this point, we could opt to use the landing page builder tool that Viral Loops offers, but since we have an established website we’ll use our own site and add the campaign there.

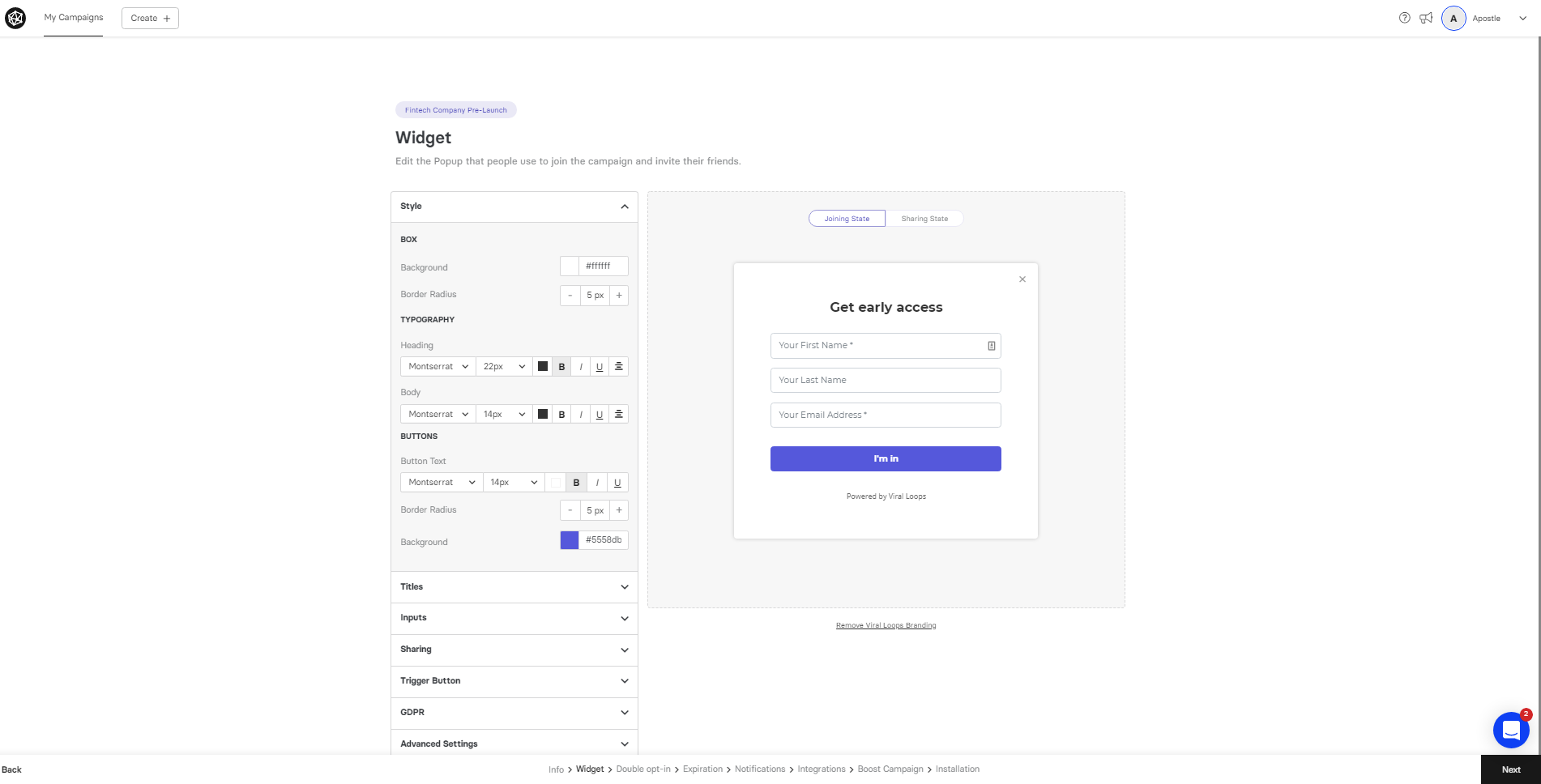

After clicking Next in the bottom right, we can start to build our campaign by customizing the widgets we’ll use, with two options:

- The joining state, which is what people will see when they join our waitlist.

- The sharing state, which is the screen presented when people opt to share the campaign.

As you can see below, when we edit the joining state widget, we can customize a range of features like the style, titles, inputs, and more:

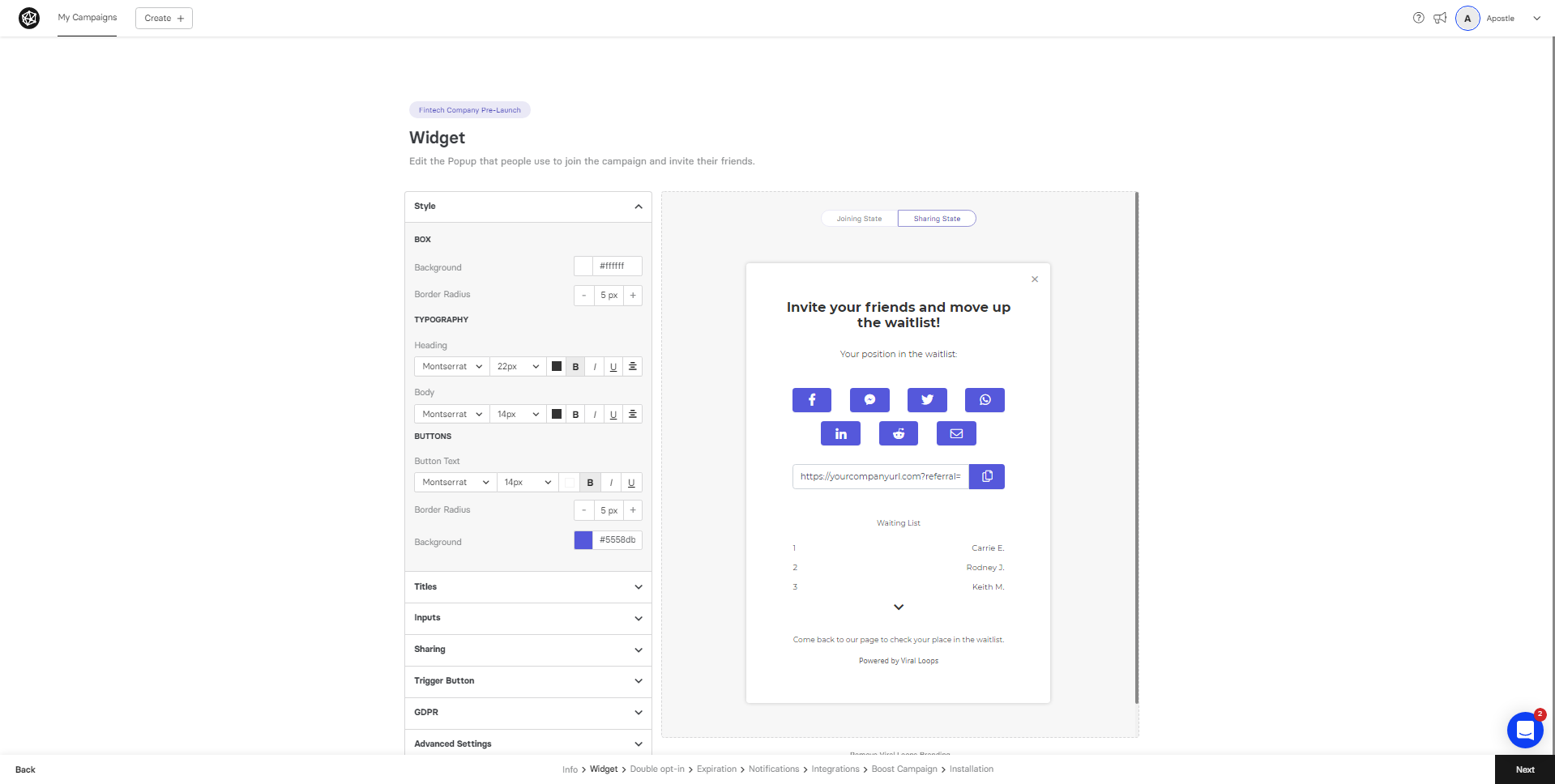

The options are pretty similar when we go to customize the sharing state widget, too:

The options are pretty similar when we go to customize the sharing state widget, too:

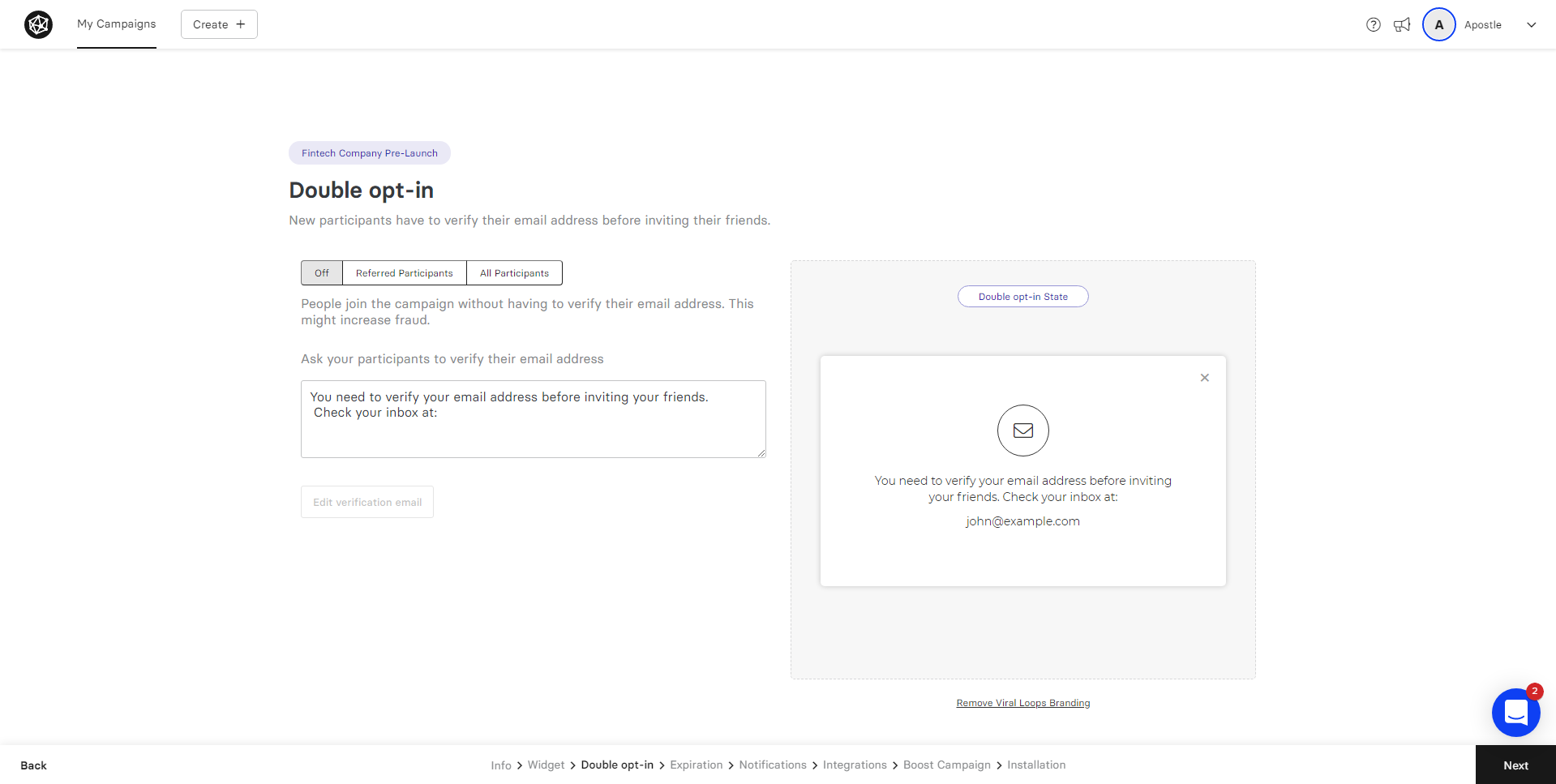

Once the creative element has been taken care of, we click Next again and move on to some important admin; whether we need to add a double opt-in, like so:

This means that participants will need to confirm their email addresses before they can be added to your waiting list, which can reduce the abuse of your campaign.

This means that participants will need to confirm their email addresses before they can be added to your waiting list, which can reduce the abuse of your campaign.

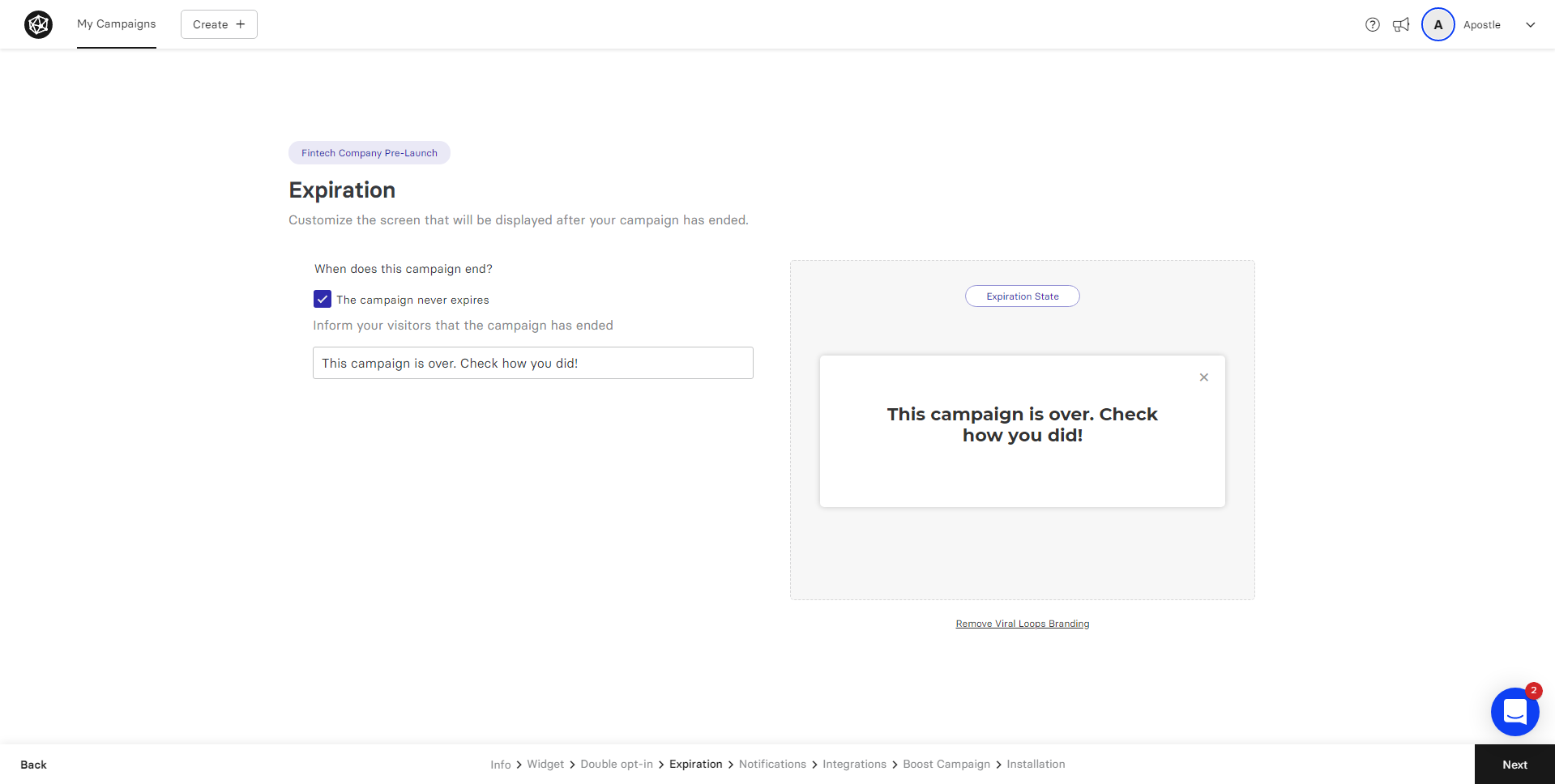

From here, we have add more basic details to the campaign – we need to set the campaign expiry date:

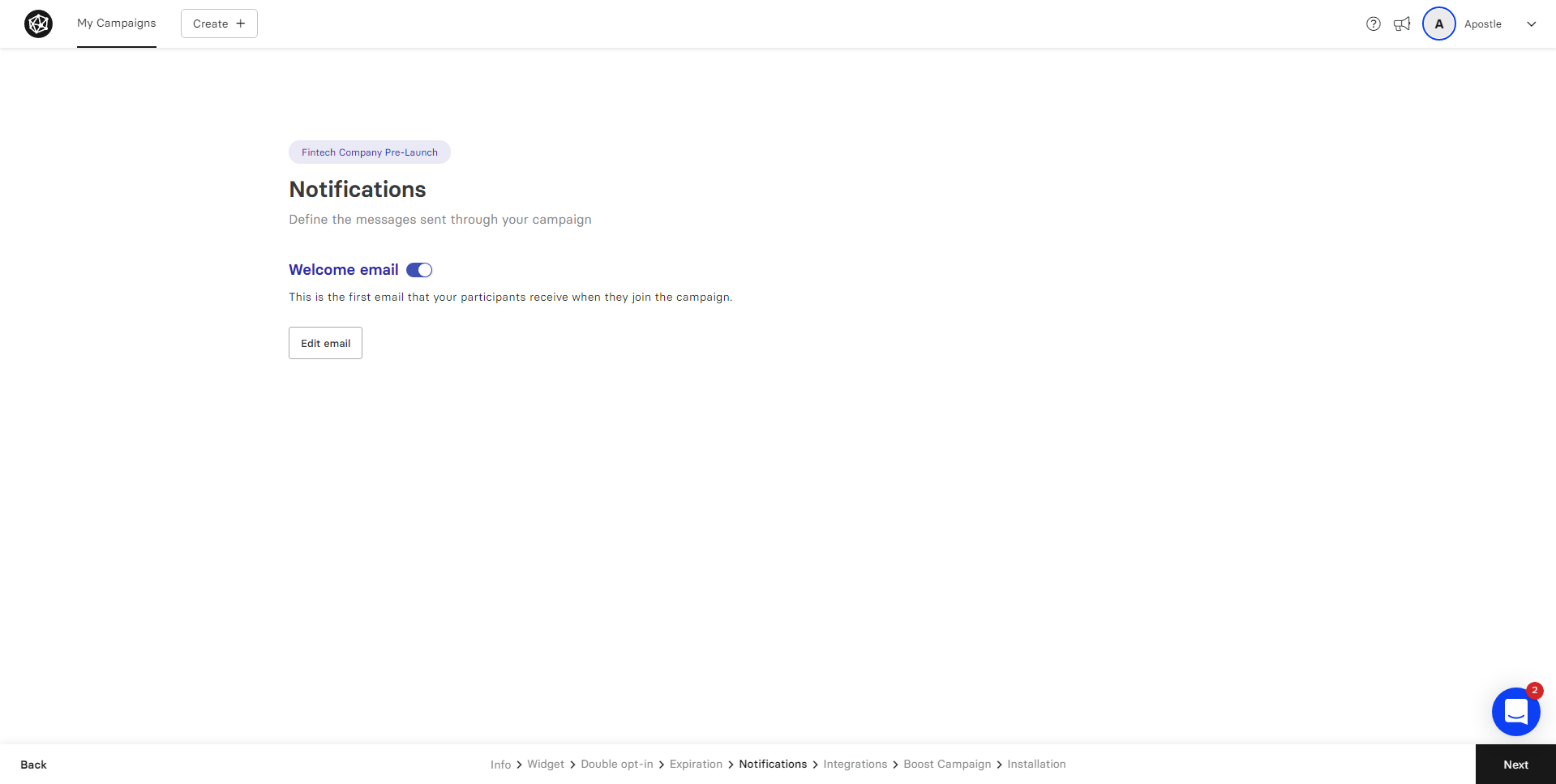

The next step in designing our customer journey through our campaign is to set up the welcome emails we’ll be sending to people who sign up for our waiting list.

The next step in designing our customer journey through our campaign is to set up the welcome emails we’ll be sending to people who sign up for our waiting list.

We toggle the option to include a welcome email, then we can create our first interaction with our future customer base, like this:

We toggle the option to include a welcome email, then we can create our first interaction with our future customer base, like this:

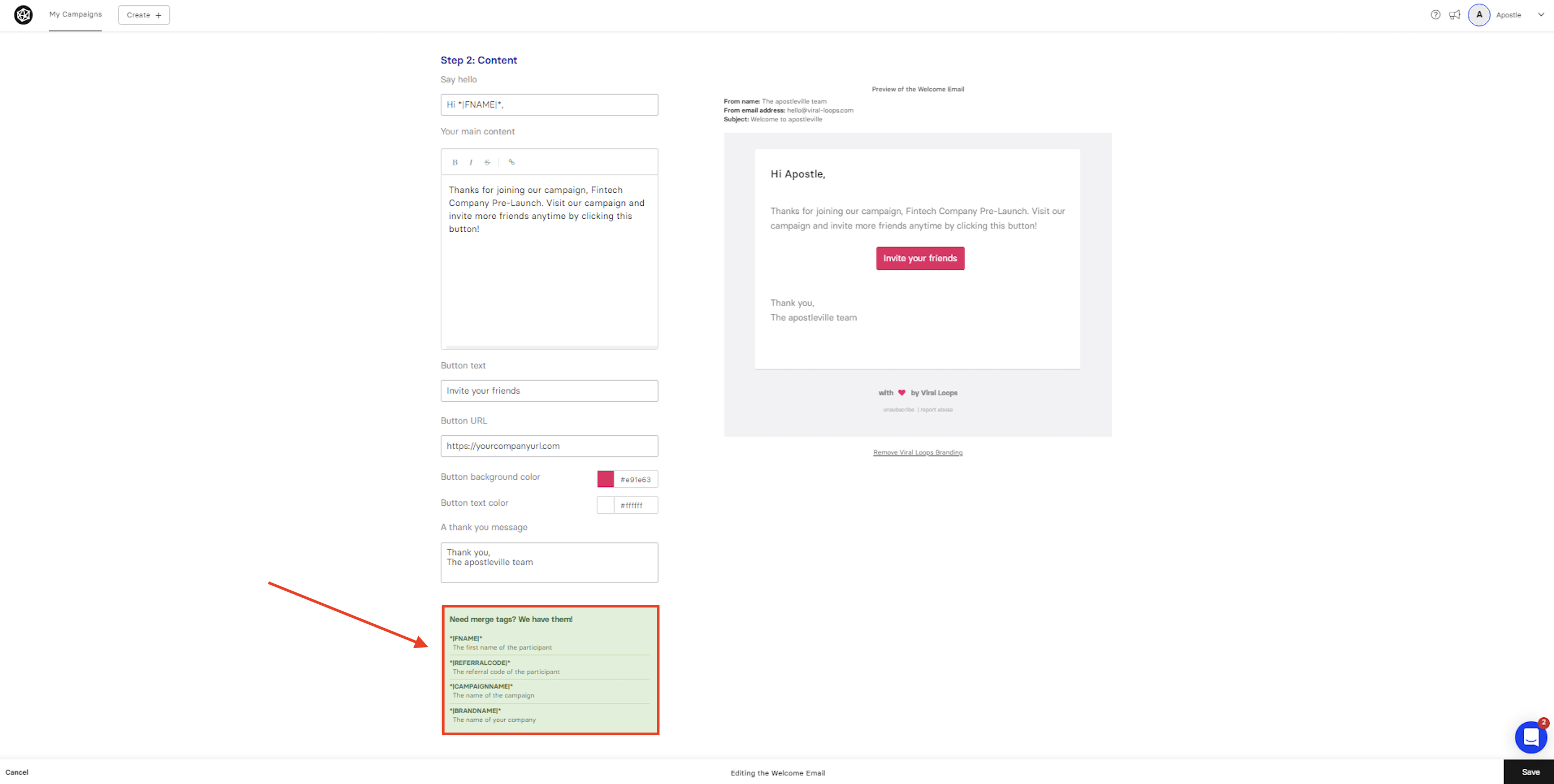

You already know how important personalization is when reaching out to existing and potential customers, right?

We can do that with the “merge tags” feature that you can see at the bottom left of the screenshot above.

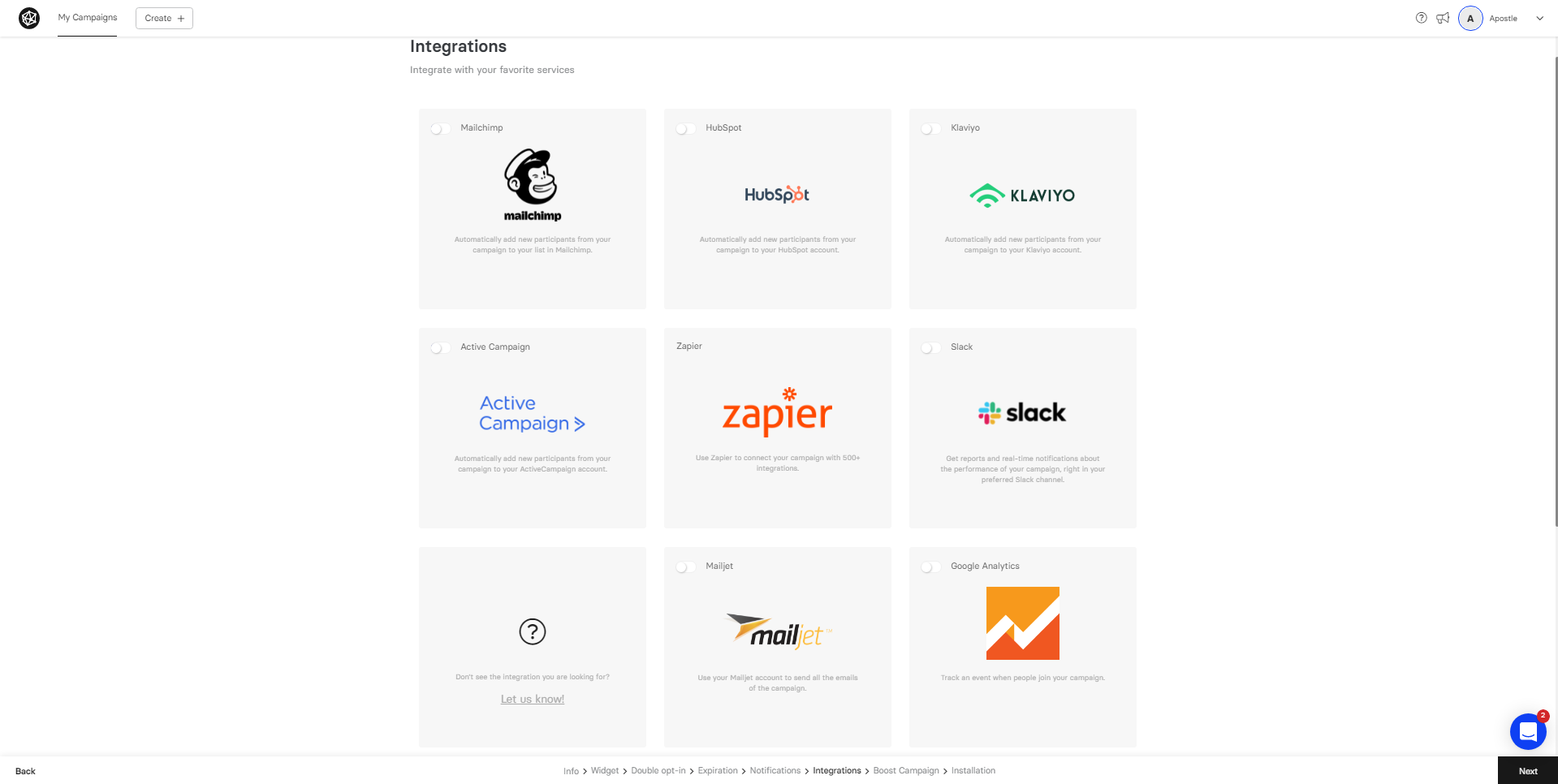

The next step is integrations; we can choose to integrate our current marketing and customer relationship manager (CRM) with Viral Loops and even create automations with Zapier.

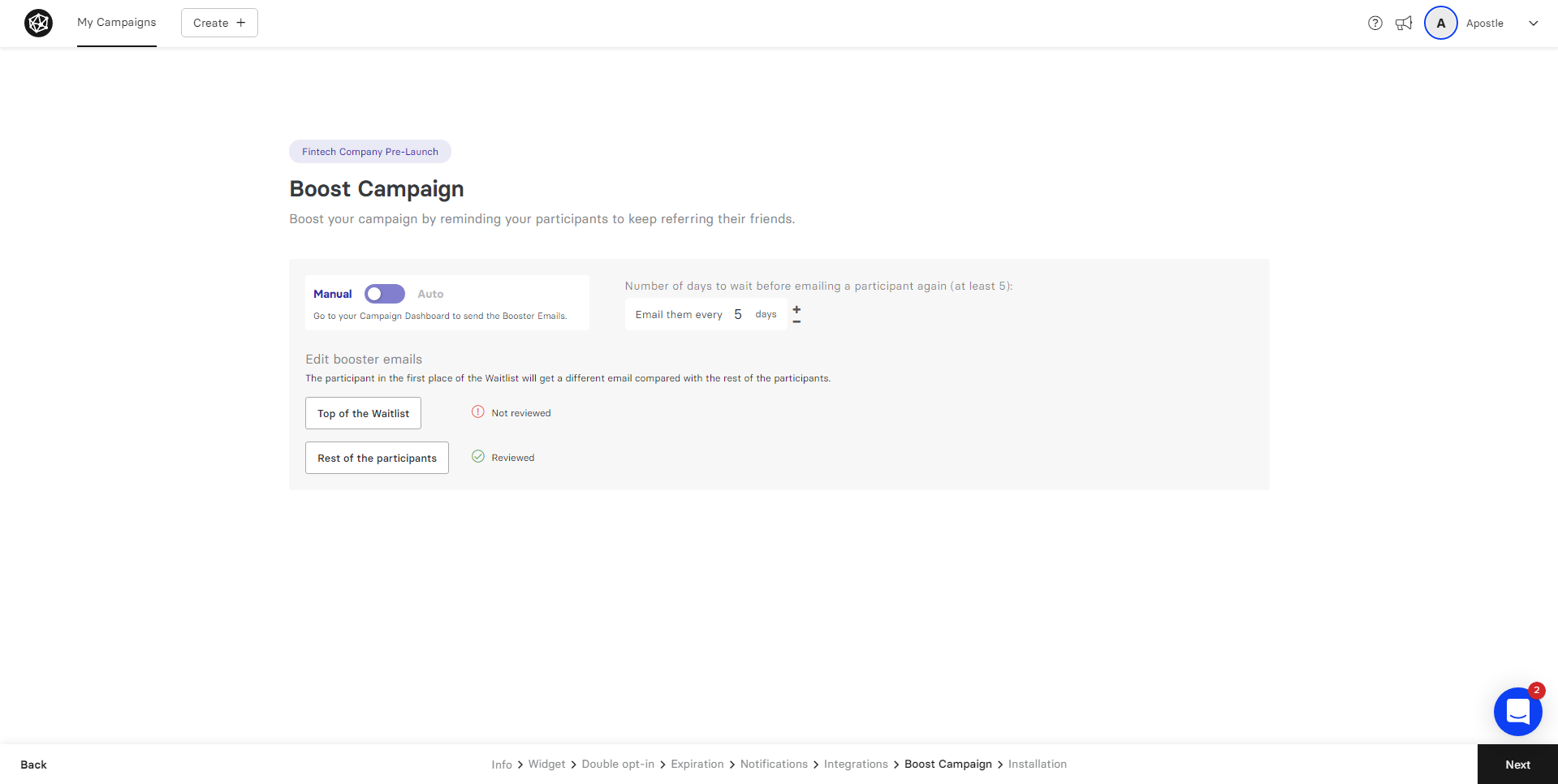

We’re nearly done setting up our referral campaign for customer acquisitions and the next step is to choose whether we want to boost our campaign with reminder emails from this screen:

We’re nearly done setting up our referral campaign for customer acquisitions and the next step is to choose whether we want to boost our campaign with reminder emails from this screen:

We can opt to send an email to the top referrer in the campaign, to the rest of the waitlist, or both.

We can opt to send an email to the top referrer in the campaign, to the rest of the waitlist, or both.

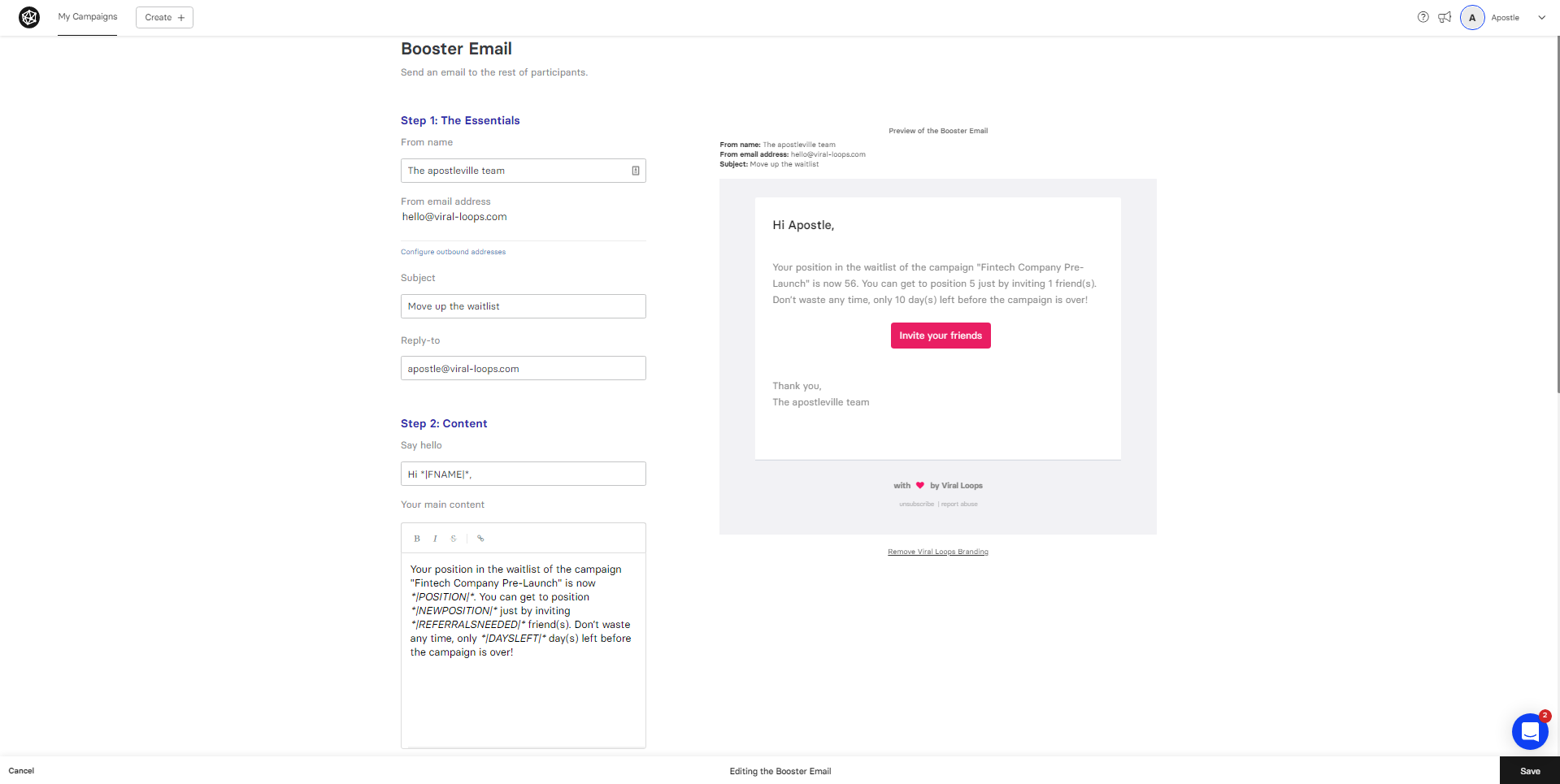

There are plenty of customization options for these emails, too:

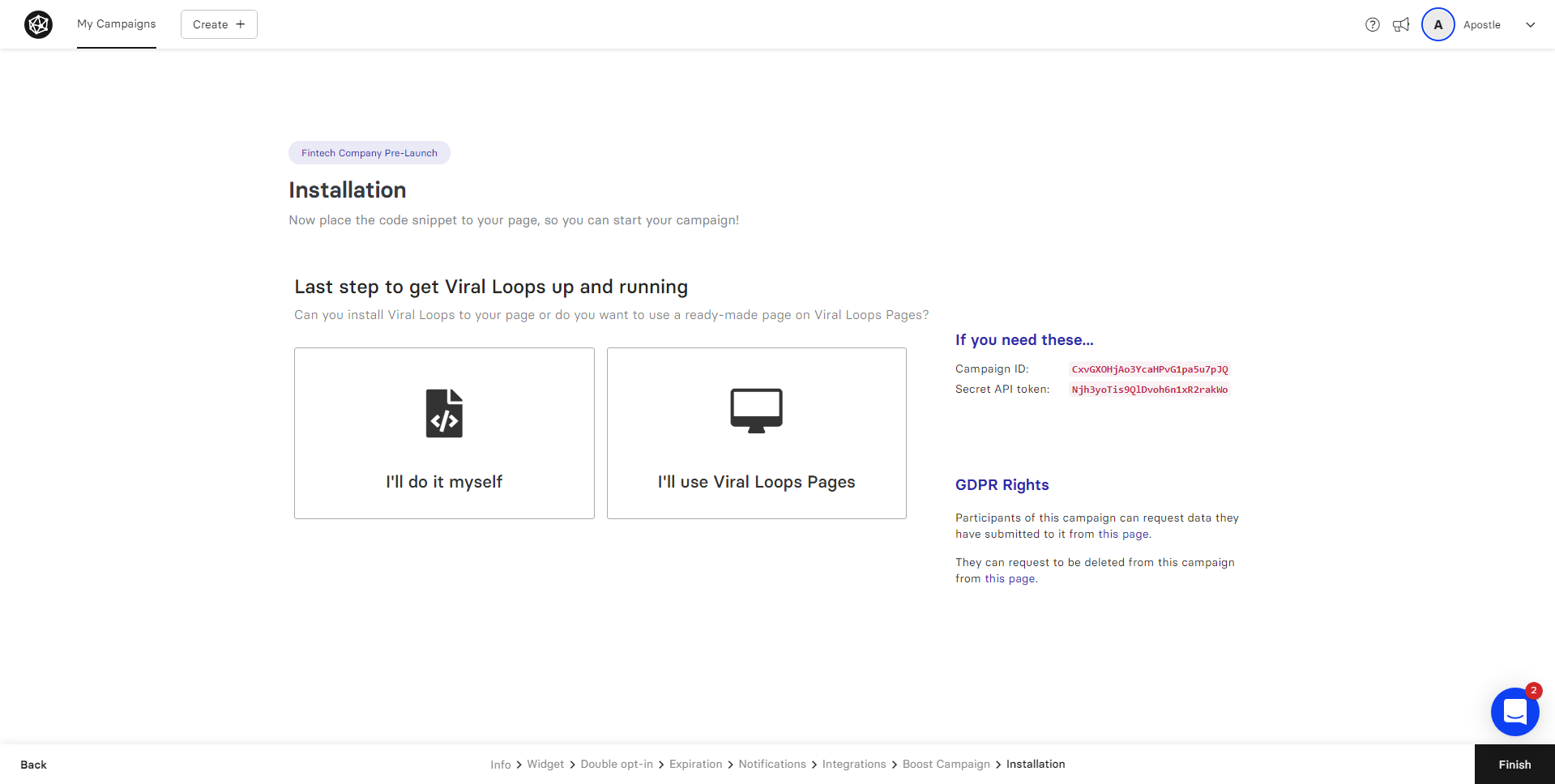

Once the email campaign is all set up, it’s time to launch our new customer referrals program!

Once the email campaign is all set up, it’s time to launch our new customer referrals program!

As we noted at the start of setting up the campaign, we can choose to host this on our own website by installing code that gets provided or through a Viral Loops landing page.

Now, it’s a case of promoting our referral program to our loyal customers, website visitors, and other prospective customers on our owned media platforms.

Now, it’s a case of promoting our referral program to our loyal customers, website visitors, and other prospective customers on our owned media platforms.

It’s worth mentioning that with our latest feature, Viral Loops Rewards, this entire campaign has an even better base for reward success and growth.

Through integrations with Stripe and Tremendous, sending out gifts for any of the templates is now a seamless process. Simplifying your next referral campaign and solidifying your CAC!

For more useful info, make sure to check out our Youtube video on Rewards for your campaign!👇

Step #4: Experiment and iterate based on results

The next step is customer acquisition management – that is, making sure the campaign is working and tweaking it when necessary.

We need to monitor all the metrics that we outlined earlier and be sure our incentives to sign up are a match for your customers.

Running A/B tests and experiments will also help us figure out the messaging that works and how we can design referral and loyalty programs in the future.

That’s how you can set up a customer acquisition strategy using a referral program to bring in new customers.

Let’s see how we figure out the cost of customer acquisition for the campaign.

How to Calculate Customer Acquisition Cost

Your CAC is based on factors like your customer acquisition methods and the product or service you’re working with.

We saw a little earlier that you’d expect an eCommerce business to have a different CAC to a SaaS company, for example.

One thing that’s always the same, though, is the way you calculate this number and you can plug in your information to our calculator below to determine your campaign’s success.

Here’s how you come to the variables that need to be plugged in.

Variable #1: Cost of sales

To calculate your cost of sales, you need to understand which parts of your sales operation works to acquire customers.

Smaller businesses may not have a sales team or department, but there may still be some costs that you need to count towards acquiring customers.

Some examples of your sales costs that you’ll need to add up to put in our calculator include:

- Your sales team costs, such as salaries, commissions, and bonuses

- Sales and lead tracking tools such as the customer relationship manager (CRM) Hubspot

- Other hardware and software you’ve invested in for a campaign like customer messaging tools

Be sure to only use spending that goes towards acquiring customers and avoid any production or service costs.

Variable #2: Cost of marketing

There’s lots of information that goes into calculating your cost of marketing.

First, you need to separate out your marketing efforts into acquisition and retention so only the marketing costs for attracting new customers go into your sums.

From here, you need to add up things like:

- Your ad spend, including offline and digital marketing costs.

- Content costs, including buying cameras for videos, courses to improve copywriting, etc.

- Technology costs, such as SaaS subscriptions to manage your acquisition campaign.

- Salaries for your marketing team; you may need to split this if someone works 50/50 on acquisition and retention campaigns.

Along with anything else that’s spent on customer acquisition in the marketing department.

Variable #3: New customers acquired

It should be easy to establish how many new customers you’ve acquired through your acquisition campaign.

You do need to take care not to include every single new customer into this number – unless you’re a brand new company and every customer has come directly from acquisition by default.

Be sure to track each customer’s journey from them becoming aware of your brand, learning about it, engaging, and then making their purchase decision.

This can be accomplished by using specific landing pages for your campaign, as we saw in the example campaign we walked you through earlier.

That’s everything you need to know about using our calculator for CAC, let’s wrap this up.

Before You Go

You’ve now got a solid grounding in customer acquisition.

We’ve gotten into what customer acquisition is and why it’s important for every company and every marketer to pay attention to it.

You’ve seen how you can use Viral Loops to create a customer acquisition campaign using our hypothetical example of a fintech company looking to get people to sign up to our waiting list for a new product.

Finally, we’ve given you our calculator to determine exactly what your customer acquisition costs are.

Want to create your own referral program for customer acquisition?

Book a demo and we’ll show how we can help reduce the costs of creating customer loyalty.

Frequently Asked Questions (FAQs)

Still got questions? We’ve got the answers you need.

Q1. How can you improve your customer acquisition cost?

You can reduce your customer acquisition costs by:

- Targeting a specific, niche audience

- Retargeting adverts to already-interested customers

- Running A/B tests to ensure you’re using the right channels

- Optimizing your content and landing pages for conversions

- Identifying where in your sales funnel you lose potential customers and fix it

- Using automations in your marketing workflows to reduce staff costs

Q2. What factors do you need to include when creating a customer acquisition strategy?

The information you need to factor in when designing your customer acquisition strategy are:

- Your target audience demographics

- What the goal of your campaign and the wider business is

- The product or service you’re marketing

- What you can afford to offer in terms of discounts or giveaways

- Your overall marketing budget

Q3. What is a good customer acquisition cost?

A good customer acquisition cost will depend on your industry and whether you sell to other businesses or direct to customers. As an example, a B2B SaaS company has an average CAC of $205 for organic acquisition, while in higher education it’s $862 and in eCommerce, it’s as low as $87.

Q4. How can you benchmark customer acquisition cost?

You will be able to find an average CAC for your industry or sector as a guide to benchmark your number. If you think these aren’t relevant to your business, you can also compare your customer lifetime value (LTV) to your CAC. Your LTV to CAC ratio should be around 3:1.